A. 3.85%

B. 7.69%

C. 7.84%

Answer:B

(1+bond-equivalent yield/2) 2 =1+annual-pay yield

In this case,

(1+bond-equivalent yield/2) 2 =1+0.0784

Therefore, bond-equivalent yield=7.69%

B is the correct answer.

(1+bond-equivalent yield/2) 2 =1+annual-pay yield

In this case,

(1+bond-equivalent yield/2) 2 =1+0.0784

Therefore, bond-equivalent yield=7.69%

B is the correct answer.

7. The U.S. Treasury spot rates are provided in the following table:

| Period | Years | Spot Rate |

| 1 | 0.5 | 2.20% |

| 2 | 1.0 | 2.50% |

| 3 | 1.5 | 2.70% |

| 4 | 2.0 | 3.20% |

A. $100.61B. $102.96

C. $98.92

Answer:A

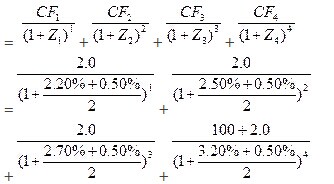

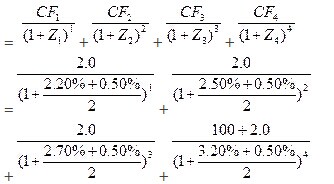

The current price should be calculated using cash flows discounted at appropriate spot rate plus corporate spread: . \1 z2 R- d0 n0 W2 \3 M2 e

Current Price

=$100.61

The current price should be calculated using cash flows discounted at appropriate spot rate plus corporate spread: . \1 z2 R- d0 n0 W2 \3 M2 e

Current Price

=$100.61

8. Tina Mo, a fixed income analyst, is asked to value a single, default-free cash flow of $60,000. She is given the information in the following table:

| Period | Years | Annual Par Yield to Maturity BEY | Theoretical Spot Rate BEY | 6-month Forward Rates BEY |

| 1 | 0.5 | 2.00% | 2.00% | 2.00% |

| 2 | 1.0 | 2.40% | 2.40% | 2.71% |

| 3 | 1.5 | 2.70% | 2.71% | 3.12% |

| 4 | 2.0 | 3.20% | 3.23% | 4.55% |

The value of this single cash flow at the end of Period 4 is closest to:A. $56,427

B. $56,309C. $56,276

Answer:C! k' R7 ~) \, h% C+ F+ u

The theoretical spot rate for Treasury securities represent the appropriate set of interest rates that should be used to value single, default-free cash flows. - i9 B8 h; J' $ x

Therefore: $60,000/(1+0.0323/2)4=$56,276

The theoretical spot rate for Treasury securities represent the appropriate set of interest rates that should be used to value single, default-free cash flows. - i9 B8 h; J' $ x

Therefore: $60,000/(1+0.0323/2)4=$56,276

9. The zero-volatility spread is a measure of the spread off:A. one point on the Treasury yield curve.

B. all points on the Treasury yield curve. C. all points on the Treasury spot curve.

Answer:C

Instead of measuring the spread to YTM, the zero-volatility spread measures the spread to Treasury spot rates necessary to produce a spot rate curve that correctly prices a risky bond. Therefore B is incorrect.

The zero-volatility spread is the equal amount that we must add to each rate on the Treasury spot yield curve in order to make the present value of the risky bond’s cash flow equal to its market price. Therefore A is incorrect.

Instead of measuring the spread to YTM, the zero-volatility spread measures the spread to Treasury spot rates necessary to produce a spot rate curve that correctly prices a risky bond. Therefore B is incorrect.

The zero-volatility spread is the equal amount that we must add to each rate on the Treasury spot yield curve in order to make the present value of the risky bond’s cash flow equal to its market price. Therefore A is incorrect.

10. The U.S. Treasury spot rates are provided in the following table:

| Period | Years | Spot Rate |

| 1 | 1 | 4.000% |

| 2 | 2 | 8.167% |

| 3 | 3 | 12.3.77% |

A. 1.50%. `! |" a) cB. 1.67%.

C. 1.76%.

Answer:B

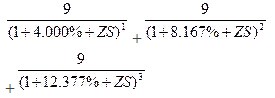

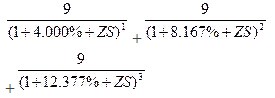

The Z- spread is the equal amount that we must add to each rate on the Treasury spot yield curve in order to make the present value of the risky bond’s cash flow equal to its market price.

To compute the Z-spread, set the present value of the bond’s cash flows equal to today’s market price. Discount each cash flow at the appropriate zero-coupon bond spot rate plus a fixed spread named ZS.

89.464 =

Solve for ZS. Note that ZS can be found by replacing Choice A, B and C into the equation to see which is the correct answer.

ZS=1.67%

The Z- spread is the equal amount that we must add to each rate on the Treasury spot yield curve in order to make the present value of the risky bond’s cash flow equal to its market price.

To compute the Z-spread, set the present value of the bond’s cash flows equal to today’s market price. Discount each cash flow at the appropriate zero-coupon bond spot rate plus a fixed spread named ZS.

89.464 =

Solve for ZS. Note that ZS can be found by replacing Choice A, B and C into the equation to see which is the correct answer.

ZS=1.67%